Let’s cut the fluff: real estate as we know it is due for a massive shake-up. Not just a little disruption — we’re talking tectonic plate shift. The kind of shift that makes you look around and wonder, “Wait, how did we ever do it the old way?” And the short answer? Tech. AI. Crypto. But not in the buzzwordy, headline-hype kind of way. In a deeply practical, totally reimagined kind of way.

First up — evaluation. AI is making property valuation brutally transparent. No more “gut feeling” from an agent with a gelled-up haircut. With LLMs like ChatGPT, data that used to be buried in spreadsheets or hidden behind a paywall is now instantly readable and explainable. A chatbot can walk you through 10 years of price trends, compare your home to five others within a 1.2km radius, and adjust for solar panels, school zones, and that nosy neighbor across the street — all in under 10 seconds.

Legalities? Streamlined. Contracts? Auto-generated. Due diligence? AI agents can now read titles, cross-reference council data, and highlight red flags without you having to pay three different people and wait a week for an email with an attachment that won’t open on mobile.

But here’s where it gets spicy — and where the *real* shift starts happening. The real value in property is moving away from bricks and mortar. Yep. You read that right. In a world where digital ownership is becoming mainstream, things like smart contracts, fractional NFTs, and tokenized assets are starting to feel more solid than the old “4-bedroom with a view” dream.

Why buy 100% of one asset in one location, when you can own 0.01% of ten high-performing digital or tokenized properties, across five cities, with liquidity and resale options *instantly*? Imagine owning a chunk of a Dubai high-rise, an LA apartment block, and a beachfront in Bali — all tracked, traded, and verified on-chain. Try pulling that off with a mortgage broker and a manila folder.

And let’s talk about risk — because that’s changing too. Traditional property has always been sold as “safe,” but between interest rate roulette, global market volatility, climate risk, and zoning changes, many investors are starting to look elsewhere. Crypto, NFTs, DAOs — these were once punchlines at dinner parties. Now they’re real wealth vehicles, backed by communities, liquidity, and innovation.

Which leads us to the elephant in the room — the traditional real estate agency. An office full of agents in tight pants cold-calling strangers? That model is crumbling. Not just because it’s outdated, but because fewer and fewer people want that life. People are realizing you don’t need a boss, an office, or even “business cards” to make money anymore. You just need a laptop, a little grit, some balls, and a good idea. The internet is a rocket ship — and the 9-5 hustle is losing passengers.

In the next 5 years, the people who “run” the property market won’t be sitting at desks. They’ll be walking beaches, building tools, flipping tokens, and closing deals from cafes. The smartest agents won’t be hired — they’ll be replaced. Not by robots, but by regular humans using robots. And honestly, we’re here for it.

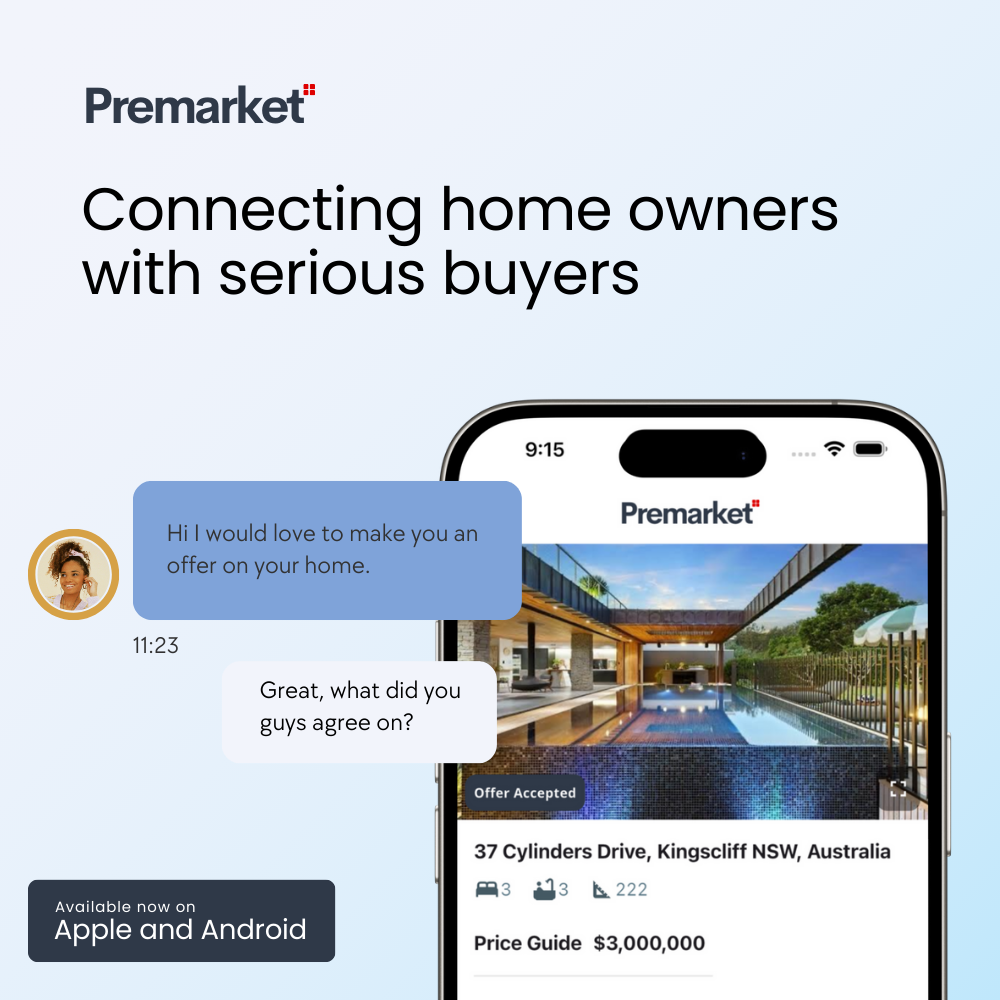

Premarket was built with this future in mind. It’s not just about bypassing agents. It’s about letting people connect without gatekeepers. Letting value flow through conversations, not commission structures. And empowering everyday Australians to test the market, explore new kinds of property, and reimagine what “owning” even means.

The future’s not coming. It’s already here. And it doesn’t wear a suit.